Coverage, Simplified.

AKKO makes protecting your stuff easier and more affordable.

1. Quick registration

Choose our phone-only or “Everything Protected” AKKO Plan. Upgrade or downgrade anytime. Save 5-15% by bundling plans or paying annually.

2. Full protection

Input your items info and share a few photos. Done! Now they're fully protected. Then simply add/remove items anytime you get new stuff.

3. Easy repairs & replacements

Get repairs done quick - often same day for phones! We pay the store or can pay by PayPal or wire immediately upon claim approval.

Love from our AKKO community

Cinny

I had to file a claim for the first time and i had so many questions. My questions were answered in a timely manner and the answers were elaborated on so i had clear information.

Robert

I'm so thrilled by this service. For only a couple dollars more than i'd been paying Verizon just for phone insurance, now all my devices are covered. I just completed a claim of my 6 year old...

Jamie

Made my claim Wednesday night or Thurs morning. Funds to replace my item were in my account Fri morning, even with me exchanging a few emails with the claims dept. Fantastic!

We protect what you

rely on

Keep your stuff protected without worry

about cost and complexity.

Choose to protect just your phone, or cover all your stuff

with our “Everything Protected” AKKO Plan.

Swap items in your account when you upgrade or buy/ sell stuff, and Never Buy Another Protection Plan Again.™

In the Press

AKKO beats out Squaretrade, AppleCare, and Geek Squad for best phone protection!

Info & FAQ

Don't worry, a lot of people sometimes think this sounds "too good to be true" so we get asked a lot of questions.

Below are the answers to most of them. If you have any others, just ask us! 😊

What items are covered by an AKKO Plan?

Our Phone-only plans cover just your 1 phone.

But our one-of-a-kind “Everything Protected” AKKO Plan covers 1 phone PLUS 25 additional items.

Select one (1) phone + any 25 of your eligible belongings to load into your AKKO account for protection. You

can swap items in and out of your AKKO plan whenever you'd like!

Electronics

Phones, laptops, tablets, smartwatches, TVs, desktop computers, monitors, etc.

Photography & Video Equipment

Cameras, lenses, accessories, tripods, gimbals, etc.

Audio & Music Gear

Speakers, electronic music instruments, DJ equipment, headphones, musical instruments, etc.

Gaming

Video game consoles, controllers, peripherals, VR, etc.

Personal Transportation (Non-Motorized)

Bikes, scooters, skateboards, unicycles

Sports & Recreational Gear

Skis, snowboards, surfboards, golf clubs, tennis rackets, camping/climbing equipment, etc.

Clothing & Accessories

Clothes, jackets, shoes, sunglasses, watches, jewelry, etc.

Appliances (only counter-top):

Blenders, coffee makers, microwaves, juicers, etc.

Handheld/Portable Power Tools

Handheld drills, circular saws, jigsaws, sanders, routers, etc. (covered only against accidental damage and theft)

School Supplies

Textbooks, backpacks, calculators, etc.

NOTE: All plans are per individual and will only cover items owned by the planholder. Plans cannot be shared

with family or friends.

Adult and Student Plan accounts protect a maximum of one (1) phone. To cover additional phones, purchase

additional adult or student plans. There are no quantity limits for other personal electronics and eligible items

you want to add to your account.

Multiple plans may be purchased at a discount with billing bundled together!

Click here for the list of items not eligible for coverage

What does an AKKO Plan protect me from?

- Cracked screens

- Spills & liquid submersion

- Accidental damage (like drops)

- Damage & malfunctions from accidental damage/drops

- Mechanical/electrical component failures (for phones)

- Theft

- Theft of items from an unattended vehicle via forced entry (car break-ins)

What is the deductible on an AKKO Plan?

The deductibles for phones on our phone-only protection plans or our “Everything Protected” AKKO Plan range from $29 - $99 per claim based on the phone's model. $99 is also the max deductible even for theft or total replacement claims - less than half as much as most other protection providers!

Click here to view the deductibles for repairs/replacements on your specific phone make/model.

If you have one of our “Everything Protected” AKKO Plans, which protect one (1) phone + 25 other items, all other items besides your phone are subject to a $99 deductible ($49 for students) for any incident of accidental damage or theft.

This amount that is "deducted" from any reimbursement payout you receive exists so that you're still motivated to be careful with your stuff.

But with all of AKKO's protection plans, we've made sure to offer easily affordable deductibles for incidents of accidental damages, breakdowns, and theft, rather than the $150 - $500 deductibles you'll encounter with many other protection plans for phones, laptops, and other electronics and personal items.

Note: Deductibles for lost phones on annually paid plans are equal to the deductible for theft on the same phone model, but there is a limit of only 1 Lost phone claim covered per 12 months. Lost phone protection is not included on phone-only plans or AKKO Plans that are paid monthly.

What is the coverage limit?

AKKO Base Plans ($15/month for adults, $10 for students) include $2,000 of reimbursement protection per incident**. There are no annual reimbursement limits or limits on the number of claims you may file.

**$2,000 PER INCIDENT means that, for instance, if you just replaced your broken phone with us and your new phone is stolen the following week, the replacement value of your phone will be covered in full (after deductible) as long as that amount is less than $2,000.

If at another point in the same year you drop your laptop and the screen is smashed, the repair cost or replacement value of the laptop will be fully covered (after deductible) as long as it's less than $2,000.

In short, there is no annual limit to your claims and reimbursement, and every incident is covered individually.

However, if during a single incident someone steals your entire backpack, which contains both your phone and laptop, up to $2,000 total is covered to reimburse you for replacing those items and any other covered contents of your backpack (including the backpack itself). Even if the combined replacement cost exceeds $2,000 for all these items, your coverage will pay out a maximum of $2,000.

Higher per-incident coverage limits are available!

Once you're registered, you can upgrade your coverage to a per-incident reimbursement limit as high as $10,000! Our most common per-incident upgrade is $3,000 - $5,000, which adds only a few dollars to your monthly premiums.

Our studies and claims data show that the $2,000 per-incident limit is more than enough for the majority of users. That said, if you would like to cover more expensive items like a high-end laptop, specialty photography or music gear, etc., we offer an easy option to upgrade your limit. Simply contact us via the "billing" section of your account to initiate an increase to your per-incident limit.

Other Limitations:

Coverage for jewelry, watches, rings and other items consisting of gold, silver, platinum or furs is limited to $1,000.00 for any one incident. Coverage for bicycles is limited to $1,000.00. Property in a personally owned automobile is covered, provided that the vehicle was locked and windows fully closed at the time of theft, and that there was visible evidence of forced entry into the vehicle.

NOTE: All plans are per individual and will only cover items that the individual owns. This means that if you file a claim, you must have proof that you are the owner of the item.

Questions about coverage limits? Contact us!

Do I need my item receipts for coverage? What if I don't have them?

For accidental damage claims, we do not require the original purchase receipts for the items you want to protect on your plan. While the receipt would be preferred, you can establish proof of ownership through other means.

For items purchased used or through a third-party marketplace platform such as Craigslist, eBay, Facebook Marketplace, or OfferUp, you may request an email be sent to you by the seller stating what you bought, when you bought it, and how much you paid for it. If an item was gifted to you, you may need to ask the gift giver for a statement that says as much.

For theft claims, proof of purchase will need to be provided. If you don't have the original receipt of your purchase, you can try to contact the original seller or retailer, as they typically have records of past transactions. You can try providing your name, phone number, email, or credit card number to try and track down a receipt for something you purchased.

You can also provide our team a record of your credit card or bank statement showing the date and amount paid for an item. Finally, if you purchased an item through a marketplace or from a private seller, you can provide a record of, for instance, a PayPal or Venmo transaction.

What items are NOT covered by an AKKO Plan?

We do not cover furniture, automobile, motorcycle, boat, motor, aircraft or aircraft parts (including drones) or any type of motorized land vehicle or other conveyances or their accessories (including car stereos, GPS navigation devices, keyless entry), money in currency or coin, evidences of debt, letters of credit, passport documents, notes, securities, transportation tickets or any other tickets, pharmaceuticals, prescription or over- the- counter, artwork, professional or amateur, antiques or collectables, animals, firearms or ammunition, salesman samples, contact lenses, keys, artificial teeth or limbs, or merchandise for sale, forms of identification, including student ID's and driver's licenses.

Reimbursement for jewelry, watches, rings, and other items consisting of gold, silver, or platinum or furs is limited to $1,000.00 for any one incident of loss.

Reimbursement for bicycles is limited to $1,000.

Property in a personally owned automobile is protected, provided that the vehicle was locked and windows are fully closed at the time of theft and there was visible evidence of forced entry into the vehicle.

Surfboards are protected for theft and damage due to mishandling on airlines, accidental damage from non-airline transportation or use/handling not included.

Appliances: only counter-top appliances such as blenders, coffee makers, toasters, or microwaves are protected. Appliances which are wall mounted or integrated into cabinetry or have any types of utility hookups such as gas or water are not covered.

Handheld/portable power tools are covered only against accidental damage and theft.

Does AKKO cover damage to my car or motor vehicle? What about items inside my car or motor vehicle?

No.

AKKO coverage does not apply to any damage, theft, or loss that affects your car or motor vehicle (such as a street scooter or motorcycle), nor any items incorporated or mounted/installed in or on the interior/exterior of your vehicle. You'll have to go through your auto insurance to recover any such losses.

However, your coverage does apply to items inside your car that are damaged or stolen, as long as you are able to provide proof of forced entry into the vehicle which indicates that your doors/windows/trunk/cargo bags were closed and locked.

Just as with any other claims for theft, you must also provide a copy of your filed police report.

Does my AKKO Plan cover lost items and lost phones?

If you lose one of your belongings, you'll need to evaluate the situation to determine whether it qualifies as theft or what's called "mysterious disappearance" (i.e., you simply misplaced your belonging and have no idea where it went).

Use tools like Find My iPhone or Google's Find My Device to try and recover your phone; similar services exist to track down a missing laptop or tablet. Take screenshots or record evidence of your attempts to recover your phone to provide the most complete set of evidence you can with your claims.

To receive reimbursement for a stolen phone or other item, you must be able to share your location timeline and/or the location timeline of the device.

If you have an Android device:

Make sure Find My Device is working and enabled. Go to your web browser, search for "Find My Device" and click the first result. Make sure you can see the device on a map displaying "last known location" along with the device name, make, and model.

If you have an iPhone:

The "Find My" app on iOS does not provide a history of your device's location, which can help provide proof of theft for your claim. Download the Google Maps app and be sure it is set to allow location access at all times. You can verify that your Google Maps timeline is available by checking here: https://www.google.com/maps/timeline

You will only need to show AKKO your location history if your phone or another item is stolen. Your location data will not be used for any purpose other than to verify your claim.

The protection you get with an AKKO Plan will cover theft of any item, but it will only cover "mysterious disappearance" of phones for customers who have signed up for an annual payment plan. Deductibles for lost phones on annually paid plans are equal to the deductible for theft on the same phone model, but there is a limit of only 1 Lost phone claim covered per 12 months. Lost phone protection is not included on phone-only plans or AKKO Plans that are paid monthly.

Why is an AKKO Plan better than renters' or homeowners' insurance?

Renter's insurance (from Lemonade, Jetty, or other established insurance providers) typically covers losses to your property from damage or theft only when you're at home and does not cover accidental damage like dropping your phone or spilling coffee on your laptop.

Accidental damage such as cracked screens, spills, and drops are more than 12 times as likely to happen as losses that renters' policies will even cover.

Additionally, the deductibles on renters' policies for losses from damage like fires, floods, or break-ins are usually $250-$1,000 - much higher than the deductible you would pay for any AKKO claim.

Furthermore, the cost of your renters' or homeowners' insurance coverage may increase when you do file a claim. The cost of your AKKO coverage will never increase from claims, no matter how many you file!

Why is an AKKO Plan such a great deal?

The short answer: because AKKO is using technology to make facilitating and managing protection for your stuff more efficient and less costly. Typical insurers charge really high fees on the insurance and protection plans you buy because of the work involved in processing policies and claims.

At AKKO, we're changing that - enabling our customers to get comprehensive, affordable and straightforward protection. We're ending the need to buy protection plans or insurance at the point of sale every time you get something new. Just add it to your AKKO plan, and you're covered!

Why have I never heard of AKKO before? Are you legit?

In a word, yes! AKKO is a legitimate and insured U.S. corporation with backing from an "A" Rated insurer, and we're rated "Excellent" on TrustPilot.

AKKO was founded in 2019, initially covering college students only with our unique protection plan that protects all of your eligible personal items for one simple, affordable monthly fee.

After working with a few large college organizations, we began the process of getting the same amazing protection plan approved to sell to anyone.

At the start of 2020, we soft-launched our “Everything Protected” AKKO Plan! Now we're trying to spread the word so people can start protecting the stuff they care about and rely upon in an affordable and easy way. Think of us as the Spotify of protection plans - just as Spotify bundled together all the songs people wanted to hear in one convenient package, we're bundling together protection for all your most valuable personal possessions - starting with your phone, but including up to 25 other items, including laptops, TVs, audio equipment, sports gear, and much more.

(We also added simple, affordable phone-only protection plans in November 2020.)

With AKKO, you'll have:

- No hidden fees

- No long lists of protection exclusions

- No restrictions on how old your stuff is

- No restrictions on protecting preowned items

- No long phone waits when you file a claim or need assistance

- And no need to wait weeks or months to actually get reimbursed!

- We're excited for you to discover AKKO: the last protection plan you'll ever need.

Any questions? Check out our FAQ or contact us!

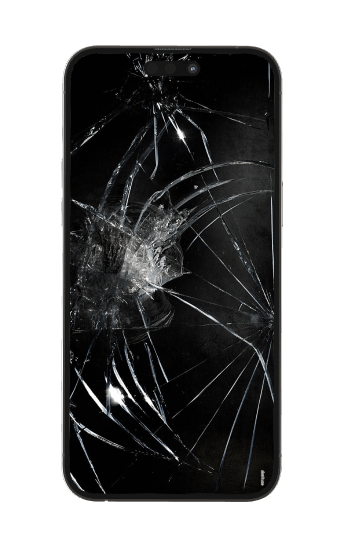

Can I sign up for an AKKO Plan to cover repairs for phones or electronics that are already damaged?

Unfortunately, that's not how protection plans work. If you have any items that are currently broken (cracked phone screen, water-damaged laptop, etc.), they are not eligible to be added to an AKKO Plan and will not be repaired or replaced by us.

For an item to be eligible for protection, you must:

1. Have an active plan with AKKO

2. Have the item's information uploaded to your account along with pictures of it in working and undamaged condition. This means that you've taken photos of the item in accordance with all the instructions we provide when you're adding an item to your account.

Then, if something happens to any of your items in the future, they're protected!

If you do have an item that's already damaged in any way, it will need to be repaired fully to be eligible for protection under our plans.

Even though it may be too late for the items you've damaged already, signing up for an AKKO plan today will ensure that you're covered in case misfortune (or clumsiness) strikes again!

Does an AKKO Plan protect my phone and other items when I travel or study abroad?

YES! As long as you're a U.S. or Canadian resident with our protection, your items are fully protected when you travel or are living/staying abroad. ANYWHERE IN THE WORLD!

The same procedures apply for filing claims if any of your items are affected by accidental damage or theft while you are abroad. Check our article here on how claims work.

AKKO will send you the funds for your claim payout electronically so you can get a repair or replacement where you are.

Please note that if your claim requires an item replacement, funds will be sent to you equal to the cost of replacement for your item based upon U.S. prices.

How can I upgrade my coverage to a higher limit?

To upgrade your coverage, just email us at billing@getAKKO.com for help with changing your coverage plan. We'll update your plan and confirm the changes with the insurance company so that your plan can have a higher coverage limit to accommodate your more expensive items, or a higher per incident limit for your stuff.

For Student Plans, we have coverage limits that range from $2,000 to $6,000 per incident in increments of $1,000, all with a $49 deductible.

For Adult Plans, we currently offer plans with per incident coverage limits of $2,000 - $6,000 in increments of $1,000, all with a $99 deductible.

If you want to protect multiple phones on a single plan, you may need to upgrade your coverage with an add-on or purchase additional AKKO Plans.

When does my coverage take effect?

Your protection begins at 12:01 a.m. Standard Time at the location of your property the day after your account is created and payment is current and activation is completed.

There is a waiting period of 30 days before any coverage under your membership plan begins (including protection against accidental damages, device malfunctions/failures, theft, or lost phones). In situations where ample photo/video evidence is available, and all photo verification steps have been completed for your item, this waiting period may be waived for cracked screen damages, but no other type of accidental damages, malfunctions, theft, or lost phones.

Be sure to follow all instructions within your account for adding photos and information for your items.

Photos of phones and tablets should be uploaded using the phone's own cameras (front and rear) to provide pictures of the front (screen) and back sides of the device by taking the photos in front of a mirror. A photo of the phone's "About" page in settings should also be provided by using another device (do not provide a screenshot) and the serial # of the device should be visible on the screen, as well as the entire front of the phone being visible.

Photos of laptops and computers should be taken by including a photo of the device with the screen powered on and also displaying the "about" page showing the specs and serial # of the computer.

Photos of TVs should also be taken where the screen is powered on and displaying video/image. Also include photo of the serial #. For gaming consoles, be sure to include photos that show the device powered on with image/video visible on a display. Do not just include photos of the gaming console itself if it has no screen.

Can I add items that are older or used to my protection plan?

Yes!

Your items are eligible for coverage through AKKO regardless of their age, where they were purchased, or whether they were purchased new or used.

See the list of eligible items here.

For items purchased used or through a third-party marketplace platform such as Craigslist, eBay, Facebook Marketplace, or OfferUp, you will need to contact the seller and request an emailed statement that identifies the item, the date it was purchased, and the amount paid. This can suffice as a purchase receipt if you need to provide one during a claim. This also applies to items that you paid for in cash. If you paid for the item via Venmo, PayPal or another payment app, you can take a screenshot of the payment.

Read more here about how purchase receipts are not required for coverage.

Can I cover a phone that is leased or financed?

Yes!

You may cover any phone that is yours and in your possession. It does not need to have been paid for in full.

Many of our customers buy phones on installment plans through their cellular carriers or other retailers.

When you register for AKKO, you'll go through essentially the normal process to add a financed phone to your account. The only difference is that instead of uploading a receipt, you'll just need to download a PDF or take a screenshot of your most recent bill/statement from the cellular carrier or retailer showing your installment payment and the type of device.

Please note that for any claim on a leased/financed phone that requires device replacement, the balance you owe for the device will have to be paid off fully before you can receive your remaining claim reimbursement.

What does an AKKO Plan protect me from?

- Cracked screens

- Spills & liquid submersion

- Accidental damage (like drops)

- Damage & malfunctions from accidental damage/drops

- Mechanical/electrical component failures (for phones)

- Theft

- Theft of items from an unattended vehicle via forced entry (car break-ins)

What is the deductible on an AKKO Plan?

The deductibles for phones on our phone-only protection plans or our “Everything Protected” AKKO Plan range from $29 - $99 per claim based on the phone's model. $99 is also the max deductible even for theft or total replacement claims - less than half as much as most other protection providers!

Click here to view the deductibles for repairs/replacements on your specific phone make/model.

If you have one of our “Everything Protected” AKKO Plans, which protect one (1) phone + 25 other items, all other items besides your phone are subject to a $99 deductible ($49 for students) for any incident of accidental damage or theft.

This amount that is "deducted" from any reimbursement payout you receive exists so that you're still motivated to be careful with your stuff.

But with all of AKKO's protection plans, we've made sure to offer easily affordable deductibles for incidents of accidental damages, breakdowns, and theft, rather than the $150 - $500 deductibles you'll encounter with many other protection plans for phones, laptops, and other electronics and personal items.

Note: Deductibles for lost phones on annually paid plans are equal to the deductible for theft on the same phone model, but there is a limit of only 1 Lost phone claim covered per 12 months. Lost phone protection is not included on phone-only plans or AKKO Plans that are paid monthly.

Does my AKKO Plan cover lost items and lost phones?

If you lose one of your belongings, you'll need to evaluate the situation to determine whether it qualifies as theft or what's called "mysterious disappearance" (i.e., you simply misplaced your belonging and have no idea where it went).

Use tools like Find My iPhone or Google's Find My Device to try and recover your phone; similar services exist to track down a missing laptop or tablet. Take screenshots or record evidence of your attempts to recover your phone to provide the most complete set of evidence you can with your claims.

To receive reimbursement for a stolen phone or other item, you must be able to share your location timeline and/or the location timeline of the device.

If you have an Android device:

Make sure Find My Device is working and enabled. Go to your web browser, search for "Find My Device" and click the first result. Make sure you can see the device on a map displaying "last known location" along with the device name, make, and model.

If you have an iPhone:

The "Find My" app on iOS does not provide a history of your device's location, which can help provide proof of theft for your claim. Download the Google Maps app and be sure it is set to allow location access at all times. You can verify that your Google Maps timeline is available by checking here: https://www.google.com/maps/timeline

You will only need to show AKKO your location history if your phone or another item is stolen. Your location data will not be used for any purpose other than to verify your claim.

The protection you get with an AKKO Plan will cover theft of any item, but it will only cover "mysterious disappearance" of phones for customers who have signed up for an annual payment plan. Deductibles for lost phones on annually paid plans are equal to the deductible for theft on the same phone model, but there is a limit of only 1 Lost phone claim covered per 12 months. Lost phone protection is not included on phone-only plans or AKKO Plans that are paid monthly.

Can I add multiple phones to my AKKO Plan?

Plans cannot be shared with friends, family members, or anyone else. All plans are per individual and will only cover items that the account holder owns.

All accounts may have up to one (1) phone on them. To add more phones, you must purchase additional plans - either phone-only or an “Everything Protected” AKKO Plan.

New Customers: - Purchase “Everything Protected” AKKO Plans for your family/group: CLICK HERE - Purchase multiple Phone-only protection plans: CLICK HERE

Current Members: - Contact our billing team via Chat or email billing@getAKKO.com to add additional plans for new members/devices

- Did you already register multiple plans? Remember, each phone has its own login. Be sure to have each member of your group/family login to their own account using their own cell phone number to activate and register their protection. (more info)

What's the process for filing a claim? How long will it take for my repair or replacement?

AKKO's mission is to make claims fast and easy for you!

The Claims Process:

1. Login to your AKKO account from your phone or computer and file your claim. 2. A team member will reach out to you within one day to collect any necessary further information or to direct you to a nearby repair provider. 3. Repairs: If your item(s) can be repaired, AKKO will either pay the repair shop directly or send you the money for repairs. If funds are paid to you directly, you can choose to receive them via PayPal, Zelle, or a wire transfer initiated the same day as claim approval. (Many of our repair claims, such as cracked phone screens, get fully resolved within 24 hours!) 4. Replacements: If your item is in need of total replacement (i.e., it's unrepairable or stolen), AKKO will send you a payout equal to the replacement value; we can also have a replacement item sent straight to you, if preferred.

Notes:

- Your deductible is subtracted from any claim payouts. (For example, if your screen repair is $158 after tax, and the repair deductible for your phone is $49, you would receive a payout of $109.)

- Claims of theft generally take longer to resolve than damage claims. Police reports and proof of purchase are required to be submitted to our team, and the time to receive the police report may vary depending on where the incident occurred.

- If you have Apple devices which a local repair provider is not able to service, then you can get them taken care of at an Apple Store. We will not force you to send away your Apple devices for repair. Our goal is to get your items fixed or replaced ASAP.

If my phone or other items need to be completely replaced, how much money do I get to do so?

Replacements: If your items are too extensively damaged (or were stolen) and you require a replacement device or item, we offer a few flexible options to best suit your preference!

1) We can send you instant cash (via PayPal, Zelle, or Check) for a refurbished replacement of your device.

2) If no replacement value can be found for your item, we would send you the funds for the value of a newer model/available.

3) Instead of cash, we can send you a refurbished device listed in very good condition.

4) Instead of cash, we can send you a newer/different device model and you pay the difference for any upgraded model.

As a general note, we find the replacement value of the item by looking at the cost of refurbished items of the same make/model/year. Check out Backmarket.com and Swappa.com to see the present value of your phone model or other devices.

For example, if your iPhone X was stolen or completely destroyed, we would find the value of a refurbished iPhone X and your payout would be the cost of the replacement, plus sales tax if applicable, then subtracting your plan's deductible ($29-$99 based upon your plan and item). This is in reference to option "1)" above if you wanted instant cash.

We will not base the value of your item off of what used iPhone X phones are being sold for by random individuals on a site like OfferUp or Craigslist. You also will not receive a payout based on the value you initially paid for the phone when it was new, unless no replacement can be found.

The same process applies to claims for other electronics and personal items on your plan which are eligible for coverage.

When does my coverage take effect?

Your protection begins at 12:01 a.m. Standard Time at the location of your property the day after your account is created and payment is current and activation is completed.

There is a waiting period of 30 days before any coverage under your membership plan begins (including protection against accidental damages, device malfunctions/failures, theft, or lost phones). In situations where ample photo/video evidence is available, and all photo verification steps have been completed for your item, this waiting period may be waived for cracked screen damages, but no other type of accidental damages, malfunctions, theft, or lost phones.

Be sure to follow all instructions within your account for adding photos and information for your items.

Photos of phones and tablets should be uploaded using the phone's own cameras (front and rear) to provide pictures of the front (screen) and back sides of the device by taking the photos in front of a mirror. A photo of the phone's "About" page in settings should also be provided by using another device (do not provide a screenshot) and the serial # of the device should be visible on the screen, as well as the entire front of the phone being visible.

Photos of laptops and computers should be taken by including a photo of the device with the screen powered on and also displaying the "about" page showing the specs and serial # of the computer.

Photos of TVs should also be taken where the screen is powered on and displaying video/image. Also include photo of the serial #. For gaming consoles, be sure to include photos that show the device powered on with image/video visible on a display. Do not just include photos of the gaming console itself if it has no screen.

Can I add items that are older or used to my protection plan?

Yes!

Your items are eligible for coverage through AKKO regardless of their age, where they were purchased, or whether they were purchased new or used.

See the list of eligible items here.

For items purchased used or through a third-party marketplace platform such as Craigslist, eBay, Facebook Marketplace, or OfferUp, you will need to contact the seller and request an emailed statement that identifies the item, the date it was purchased, and the amount paid. This can suffice as a purchase receipt if you need to provide one during a claim. This also applies to items that you paid for in cash. If you paid for the item via Venmo, PayPal or another payment app, you can take a screenshot of the payment.

Read more here about how purchase receipts are not required for coverage.

Can I cover a phone that is leased or financed?

Yes!

You may cover any phone that is yours and in your possession. It does not need to have been paid for in full.

Many of our customers buy phones on installment plans through their cellular carriers or other retailers.

When you register for AKKO, you'll go through essentially the normal process to add a financed phone to your account. The only difference is that instead of uploading a receipt, you'll just need to download a PDF or take a screenshot of your most recent bill/statement from the cellular carrier or retailer showing your installment payment and the type of device.

Please note that for any claim on a leased/financed phone that requires device replacement, the balance you owe for the device will have to be paid off fully before you can receive your remaining claim reimbursement.

Are unlocked phones covered?

With an AKKO Plan, you may cover any phone which is yours and in your possession. It does not matter what carrier you use or if your phone is unlocked or financed. Our AKKO Plan is only $15 per month and protects your unlocked phone against Accidental Damage & Theft along with nearly all your other personal electronics and gear at no extra cost!

When you register, the same process applies for adding your phone to your account. You will take pictures of its front and back to verify its working and undamaged condition.

Learn more about coverage on phones here.

What if I want to sign up for AKKO but my phone is already broken?

We require that your phone be in undamaged and in full working condition at the time you sign up for one of

our plans. However, we understand that life happens and things don't always work out that way.

That's why we're offering $20 toward your repair when you sign up for AKKO with a phone that's already

broken - and once your phone is fixed, we'll cover it moving forward.

Once you sign up (using the promo code BREAK1), we'll help you find a local repair shop that'll get your phone

shipshape. Once you're all fixed up, just show us your receipt and we'll PayPal you $20! It's that easy.

What does an AKKO Plan protect me from?

- Cracked screens

- Spills & liquid submersion

- Accidental damage (like drops)

- Damage & malfunctions from accidental damage/drops

- Mechanical/electrical component failures (for phones)

- Theft

- Theft of items from an unattended vehicle via forced entry (car break-ins)

What is the coverage limit?

AKKO Base Plans ($15/month for adults, $10 for students) include $2,000 of reimbursement protection per incident**. There are no annual reimbursement limits or limits on the number of claims you may file.

**$2,000 PER INCIDENT means that, for instance, if you just replaced your broken phone with us and your new phone is stolen the following week, the replacement value of your phone will be covered in full (after deductible) as long as that amount is less than $2,000.

If at another point in the same year you drop your laptop and the screen is smashed, the repair cost or replacement value of the laptop will be fully covered (after deductible) as long as it's less than $2,000.

In short, there is no annual limit to your claims and reimbursement, and every incident is covered individually.

However, if during a single incident someone steals your entire backpack, which contains both your phone and laptop, up to $2,000 total is covered to reimburse you for replacing those items and any other covered contents of your backpack (including the backpack itself). Even if the combined replacement cost exceeds $2,000 for all these items, your coverage will pay out a maximum of $2,000.

Higher per-incident coverage limits are available!

Once you're registered, you can upgrade your coverage to a per-incident reimbursement limit as high as $10,000! Our most common per-incident upgrade is $3,000 - $5,000, which adds only a few dollars to your monthly premiums.

Our studies and claims data show that the $2,000 per-incident limit is more than enough for the majority of users. That said, if you would like to cover more expensive items like a high-end laptop, specialty photography or music gear, etc., we offer an easy option to upgrade your limit. Simply contact us via the "billing" section of your account to initiate an increase to your per-incident limit.

Other Limitations:

Coverage for jewelry, watches, rings and other items consisting of gold, silver, platinum or furs is limited to $1,000.00 for any one incident. Coverage for bicycles is limited to $1,000.00. Property in a personally owned automobile is covered, provided that the vehicle was locked and windows fully closed at the time of theft, and that there was visible evidence of forced entry into the vehicle.

NOTE: All plans are per individual and will only cover items that the individual owns. This means that if you file a claim, you must have proof that you are the owner of the item.

Questions about coverage limits? Contact us!

Do I need my item receipts for coverage? What if I don't have them?

For accidental damage claims, we do not require the original purchase receipts for the items you want to protect on your plan. While the receipt would be preferred, you can establish proof of ownership through other means.

For items purchased used or through a third-party marketplace platform such as Craigslist, eBay, Facebook Marketplace, or OfferUp, you may request an email be sent to you by the seller stating what you bought, when you bought it, and how much you paid for it. If an item was gifted to you, you may need to ask the gift giver for a statement that says as much.

For theft claims, proof of purchase will need to be provided. If you don't have the original receipt of your purchase, you can try to contact the original seller or retailer, as they typically have records of past transactions. You can try providing your name, phone number, email, or credit card number to try and track down a receipt for something you purchased.

You can also provide our team a record of your credit card or bank statement showing the date and amount paid for an item. Finally, if you purchased an item through a marketplace or from a private seller, you can provide a record of, for instance, a PayPal or Venmo transaction.

When my items are Damaged or Stolen, what do I do?

AKKO is all about making claims easy and fast for you!

Here is the process for claims:

1. Login to your AKKO account and file your claim from your phone or the web.

2. A team member will reach out to you the same or next day to collect any applicable extra information, or to direct you to a nearby repair provider.

3. Repairs: If your item is in need of repairs, AKKO will either pay you or a repair shop for repairs for your item(s). If funds are paid to you directly, you can receive funds via PayPal, Zelle, or a wire transfer initiated the same-day as claim approval. (many of our repair claims, such as cracked phone screens, get fully resolved within 24hrs!)

4. Replacements: If your item is in need of total replacement (unrepairable or stolen), AKKO will send you a payout equal to the replacement value, or can also have a replacement item sent straight to you.

Notes:

- Your deductible is subtracted from any claim payouts. (for example, if your screen repair is $158 after tax, and the repair deductible for your phone is $49, you would receive a payout of $109)

- Claims of theft will take longer to resolve than damage claims. Police reports and proof of purchase are required and copies must be submitted to our team, the time to receive a report may vary based on where you live.

- If you have Apple devices which a local repair provider is not able to service, then you can get them taken care of at an Apple Store, we WILL NOT force you to send us your Apple devices to get repaired. Our goal is to get your items fixed/replaced ASAP

How do we determine the replacement value of your items?

If your item(s) are too extensively damaged (or were stolen) and you require a replacement device or item, our team member will find the replacement value of the item by looking at the cost of an available refurbished replacement of the same make/model/year/specs then send you a reimbursement payout.

For example, if your iPhone X was stolen or completely destroyed, we would find the value of a refurbished iPhone X and your payout would be the cost of the replacement, plus sales tax if applicable, then subtracting your plan's deductible ($29-$99 based on your phone, or for non-phone items $99 on our “Everything Protected” AKKO Plan for adults, and $49 for students).

AKKO will not determine the value of your item based on what used iPhone X phones or other items are being sold for by random individuals online. Replacement values are only determined based off items sold by businesses. You also will not receive a payout based on the value you initially paid for your phone or any other affected item when it was new.

The same process applies to claims for other electronics and personal items on your plan which are eligible for protection.

PHONE THEFT: For the theft of a phone to be eligible for reimbursement, you must be able to share your google location timeline to prove the last known location of the device prior to it being stolen. If you do not have the Google Maps mobile application installed on your device, you must do so in order for theft of the phone to be protected, or have a similar device tracking software/tool which is capable of displaying the last known location of a device with a timeline/history. A mobile app or tool such as iPhone's "Find My" is not sufficient enough as it can only prove the present location of a device and cannot display a timeline/history of its location. If you have any questions regarding theft of phones or need assistance setting up a proper mobile app or tool, please contact us.

Note: if you registered prior to November 3, 2020, different terms may apply, please reference all terms and conditions.

Can I sign up for an AKKO Plan to cover repairs for phones or electronics that are already damaged?

No.

Unfortunately, that's not how protection plans work. If you have any items that are currently broken (cracked phone screen, water-damaged laptop, etc.), they are not eligible to be added to an AKKO Plan and will not be repaired or replaced by us.

For an item to be eligible for protection, you must:

1. Have an active plan with AKKO

2. Have the item's information uploaded to your account along with pictures of it in working and undamaged condition. This means that you've taken photos of the item in accordance with all the instructions we provide when you're adding an item to your account.

Then, if something happens to any of your items in the future, they're protected!

If you do have an item that's already damaged in any way, it will need to be repaired fully to be eligible for protection under our plans.

Even though it may be too late for the items you've damaged already, signing up for an AKKO plan today will ensure that you're covered in case misfortune (or clumsiness) strikes again!

How long does it take to receive payment for my Repairs/Replacement once my claim is approved?

After your claim is approved, we'll transfer you funds to reimburse you for your repairs/replacement, less your deductible same-day!

What's the process for filing a claim? How long will it take for my repair or replacement?

AKKO's mission is to make claims fast and easy for you!

The Claims Process:

1. Login to your AKKO account from your phone or computer and file your claim. 2. A team member will reach out to you within one day to collect any necessary further information or to direct you to a nearby repair provider. 3. Repairs: If your item(s) can be repaired, AKKO will either pay the repair shop directly or send you the money for repairs. If funds are paid to you directly, you can choose to receive them via PayPal, Zelle, or a wire transfer initiated the same day as claim approval. (Many of our repair claims, such as cracked phone screens, get fully resolved within 24 hours!) 4. Replacements: If your item is in need of total replacement (i.e., it's unrepairable or stolen), AKKO will send you a payout equal to the replacement value; we can also have a replacement item sent straight to you, if preferred.

Notes:

- Your deductible is subtracted from any claim payouts. (For example, if your screen repair is $158 after tax, and the repair deductible for your phone is $49, you would receive a payout of $109.)

- Claims of theft generally take longer to resolve than damage claims. Police reports and proof of purchase are required to be submitted to our team, and the time to receive the police report may vary depending on where the incident occurred.

- If you have Apple devices which a local repair provider is not able to service, then you can get them taken care of at an Apple Store. We will not force you to send away your Apple devices for repair. Our goal is to get your items fixed or replaced ASAP.

If my phone or other items need to be completely replaced, how much money do I get to do so?

Replacements: If your items are too extensively damaged (or were stolen) and you require a replacement device or item, we offer a few flexible options to best suit your preference!

1) We can send you instant cash (via PayPal, Zelle, or Check) for a refurbished replacement of your device.

2) If no replacement value can be found for your item, we would send you the funds for the value of a newer model/available.

3) Instead of cash, we can send you a refurbished device listed in very good condition.

4) Instead of cash, we can send you a newer/different device model and you pay the difference for any upgraded model.

As a general note, we find the replacement value of the item by looking at the cost of refurbished items of the same make/model/year. Check out Backmarket.com and Swappa.com to see the present value of your phone model or other devices.

For example, if your iPhone X was stolen or completely destroyed, we would find the value of a refurbished iPhone X and your payout would be the cost of the replacement, plus sales tax if applicable, then subtracting your plan's deductible ($29-$99 based upon your plan and item). This is in reference to option "1)" above if you wanted instant cash.

We will not base the value of your item off of what used iPhone X phones are being sold for by random individuals on a site like OfferUp or Craigslist. You also will not receive a payout based on the value you initially paid for the phone when it was new, unless no replacement can be found.

The same process applies to claims for other electronics and personal items on your plan which are eligible for coverage.

Are Apple Store repairs covered?

After you file a claim for your Apple devices, we'll direct you to the closest repair provider able to handle your claim and provide repairs for your item.

If no nearby repair provider is able to service your Apple devices, you can go directly to an Apple Store or use Apple's mail-in services for repairs. We'll never require you to ship us your Apple devices!

We want your items fixed ASAP.

All repairs that are completed through your claims with AKKO at any repair provider are also backed by a 12 month warranty!

How can I upgrade my coverage to a higher limit?

To upgrade your coverage, just email us at billing@getAKKO.com for help with changing your coverage plan. We'll update your plan and confirm the changes with the insurance company so that your plan can have a higher coverage limit to accommodate your more expensive items, or a higher per incident limit for your stuff.

For Student Plans, we have coverage limits that range from $2,000 to $6,000 per incident in increments of $1,000, all with a $49 deductible.

For Adult Plans, we currently offer plans with per incident coverage limits of $2,000 - $6,000 in increments of $1,000, all with a $99 deductible.

If you want to protect multiple phones on a single plan, you may need to upgrade your coverage with an add-on or purchase additional AKKO Plans.

What if I want to sign up for AKKO but my phone is already broken?

We require that your phone be in undamaged and in full working condition at the time you sign up for one of

our plans. However, we understand that life happens and things don't always work out that way.

That's why we're offering $20 toward your repair when you sign up for AKKO with a phone that's already

broken - and once your phone is fixed, we'll cover it moving forward.

Once you sign up (using the promo code BREAK1), we'll help you find a local repair shop that'll get your phone

shipshape. Once you're all fixed up, just show us your receipt and we'll PayPal you $20! It's that easy.

What kind of mechanical/electrical breakdown protection does AKKO provide?

NOTE: For phones, mechanical/electrical issues are covered regardless of when you purchased the phone and whether it was purchased used, new, or refurbished. It just needs to be undamaged and fully functional at the time you register. For all other items, the below conditions apply.

Our AKKO Plan ($15/month plan that protects 1 phone + 25 items) includes a mechanical/electrical components failure protection guarantee for all your portable electronic devices (such as laptops, tablets, smartwatches, and headphones) and TVs that lasts for 36 months from the date of purchase of each device.

Portable electronic devices and TVs you add to your AKKO account for this protection must have been purchased "new" by you either within the 120 days prior to your registration, or anytime after you registered your plan. You must upload your purchase receipt with each device you wish to have this protection to your AKKO account.

It's basically like having FREE 3-year mechanical warranties on all of your portable electronic devices and TVs!

Terms:

For any of your portable electronic devices or TVs that already have an active warranty which covers mechanical/electrical component failures (either provided by the manufacturer of the device, a retailer/reseller, or third party) any claims pertaining to mechanical/electrical component failures would first go through your existing/included warranty.

After any existing warranty expires covering mechanical/electrical failures for your eligible devices, AKKO would take over for the remainder of the 36-month period that began on the date of purchase of the eligible portable electronic device or TV.

A portable electronic device is defined as any device which requires either an internal or external battery to operate. In addition to portable electronics, this protection and these terms also apply to TVs. All claims are still subject to your plan's standard service fees/deductibles.

This special protection ends for your devices if you cancel your plan with AKKO and cannot be resumed even if you choose to re-enroll with AKKO at a later point in time.

Can I get a group discount when buying multiple AKKO Plans? For my family, company, club, school, or fraternity/sorority?

Yes! We'd be happy to help you bring our amazing coverage and services to the members of your family, company, club, school, or other organization like a fraternity or sorority.

Contact us and we can easily generate a special discount code for your group.

How do I cancel my AKKO Plan?

From the "support" section in the app, you can choose the link to "cancel my plan" or email us at billing@getAKKO.com

Your plan can either continue until the end of your billing cycle, or be terminated immediately and then you will receive an appropriate pro-rated refund.

How do I update my address on my account?

Please email us at billing@getAKKO.com with a message saying "my new mailing address" and then put your

new address. Simple! 😊

How can I Change or Update my Credit Card on my account?

Simply login to your account and navigate to your Account Settings. Scroll down and you'll be able to update the payment method on your account under the "Billing" section. If you need any assistance, just email "billing@getAKKO.com"

To keep your info safe and secure, we only use Stripe (a leading payment processor and tech company) for all billing management.

You can also update your billing info over the phone if you prefer by calling us during business hours at: +1 (415) 523-9233

We're open M-F from 9-5 Pacific Time.

How can I upgrade my coverage to a higher limit?

To upgrade your coverage, just email us at billing@getAKKO.com for help with changing your coverage plan. We'll update your plan and confirm the changes with the insurance company so that your plan can have a higher coverage limit to accommodate your more expensive items, or a higher per incident limit for your stuff.

For Student Plans, we have coverage limits that range from $2,000 to $6,000 per incident in increments of $1,000, all with a $49 deductible.

For Adult Plans, we currently offer plans with per incident coverage limits of $2,000 - $6,000 in increments of $1,000, all with a $99 deductible.

If you want to protect multiple phones on a single plan, you may need to upgrade your coverage with an add-on or purchase additional AKKO Plans.